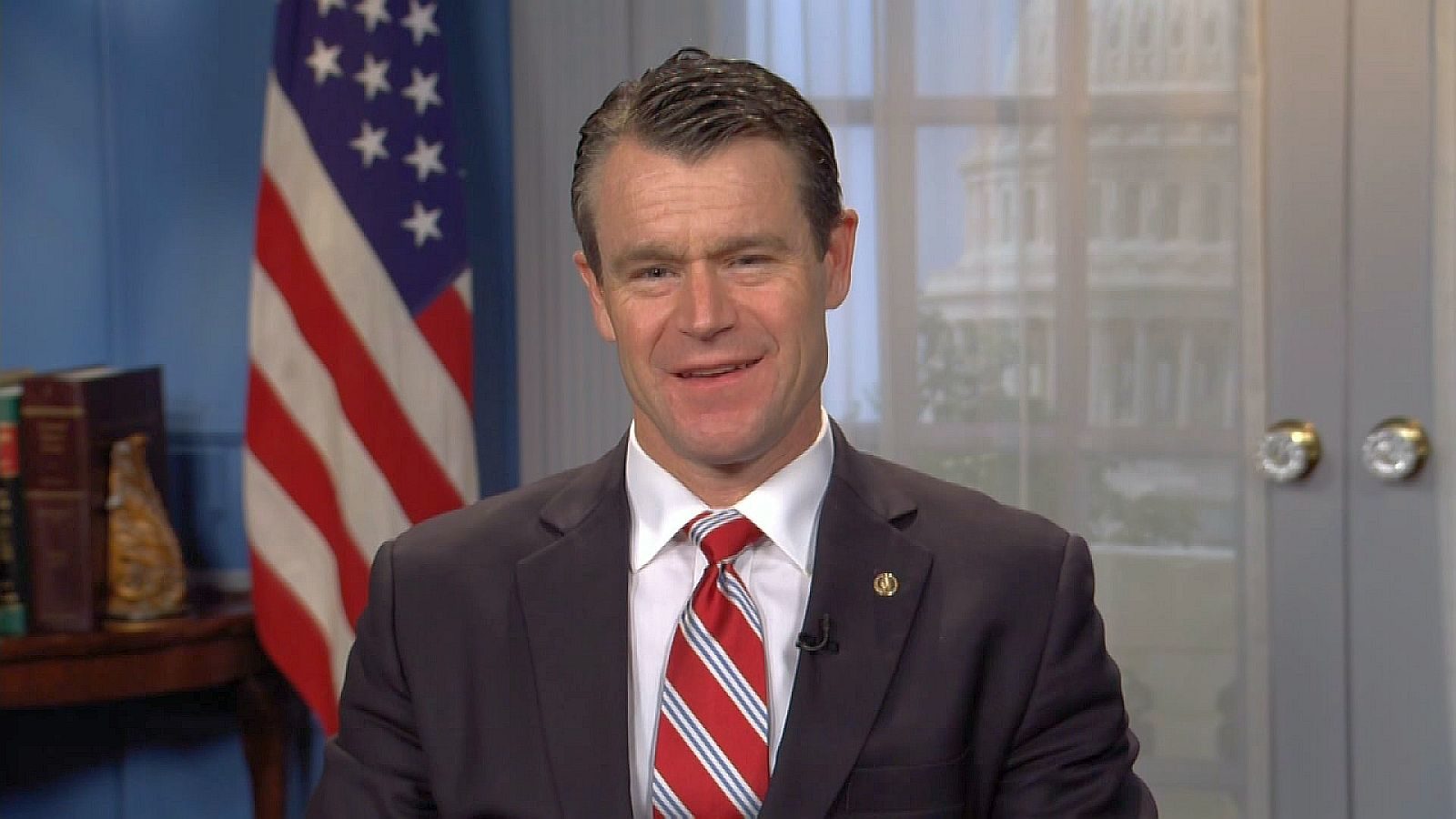

U.S. Senator Todd Young (R-Ind.), a member of the U.S. Senate Finance Committee, last week supported the United States-Taiwan Expedited Double-Tax Relief Act during a Finance Committee executive session. The legislation would relieve double taxation on investment between the United States and Taiwan, strengthening our nations’ partnership. The legislation passed the committee and now heads to the full Senate for consideration.

During the session, Young delivered the following remarks:

“Thank you, Chairman Wyden and Ranking Member Crapo, for holding today’s markup. Our relationship with Taiwan is of critical importance for both economic and national security reasons. Taiwan is a friend who we must support, and it is imperative that we work to deepen and broaden the economic ties between our two countries.

“However, currently, U.S. and Taiwanese businesses are double-taxed. This prohibitive tax policy creates unnecessary burdens for U.S. and Taiwanese businesses alike and acts as a deterrent for our Taiwanese partners looking to invest in the United States and our skilled workforce.

“As we partner with our allies, including Taiwan, to counter China’s efforts to dominate the 21st Century global economy, we must continue to evaluate where our own policies undermine U.S. competitiveness and find better solutions that will propel the U.S. economy forward.

“This must include both policies that allow for greater economic cooperation and investment with our foreign partners, including Taiwan, but also domestic policies that prioritize investment in the U.S. workforce – policies like R&D expensing which incentivize U.S. companies to re-invest in innovative technologies critical to our national competitiveness and which supply American workers with greater opportunity.

“Unfortunately, the expiration of Section 174 has left many small businesses facing challenging decisions about the future of their company. Some of these employers are now unable to make payroll and are looking at closing their doors as a result of Congress’s failure to act. We’re talking about people losing their jobs because businesses are no longer able to expense their R&D costs.

“I am encouraged that the Committee is taking this step to ensure that our tax structure reflects the strength of our relationship with Taiwan, and I encourage my colleagues to similarly take action on critical tax provisions, such as Section 174 R&D expensing, to ensure that we continue to support the U.S. workforce and further incentivize innovation here in the U.S.

“I look forward to continuing to work with members of the Committee to address these issues this year.”

Young visited Taiwan earlier this year, and he has supported legislation to address this issue.