On October 17th Page Sansone from Bakertilly Municipal Advisors presented the County Commissioners with the financial report they had contracted for. The commissioners selected specific funds to review. That review included operating receipts, operating disbursements, non-operating receipts, and non-operating disbursements for the calendar years ending December 31, 2022, through 2026.

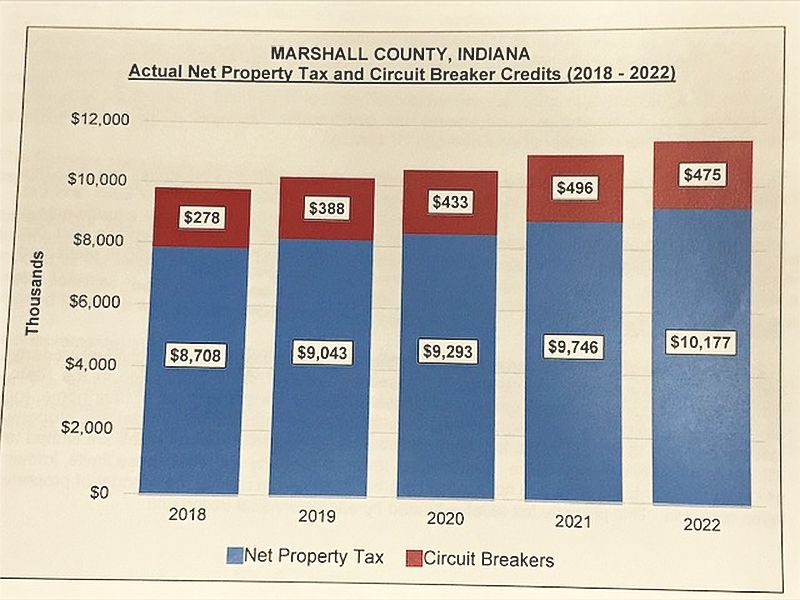

Sansone said the impact of the Circuit Breaker Tax Credits hasn’t been very impactful to the county. In 2022, 4.5% of property taxes levied by the County will be returned to property taxpayers through circuit breaker credits. (The graph below compares the amount of property taxes assessed with the amount of property taxes collected. The amounts shown in red are the amounts of property tax relief given to property owners funded by Marshall County through reductions in property tax collections.) In this current year, 2022 the county is levying about $10.6 to $10.7 million and won’t collect about $475,000 because of credits returned to the taxpayers.

As the net assessed values go up the expectation is that the circuit breakers will go down or at least maintain. If tax rates increase, that’s where the county will see more tax credits because people will get to the tax caps quicker and there are more tax credits issued.

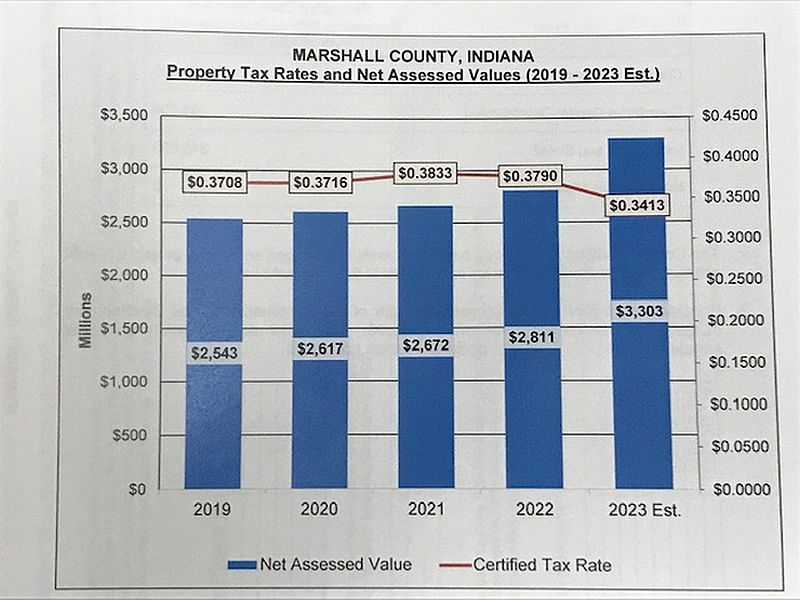

The comparison of Net Assessed Values. (The blue bar is the net assessed values and the red line is the county’s tax rates.) From 2019 to 2022, the net assessed value increased by 10.5% and the tax rate increased by 2.2%. The 2023 net assessed value is 17.5% higher than 2022 and as a result, the 2023 property tax rate is expected to decrease by 9.9%.

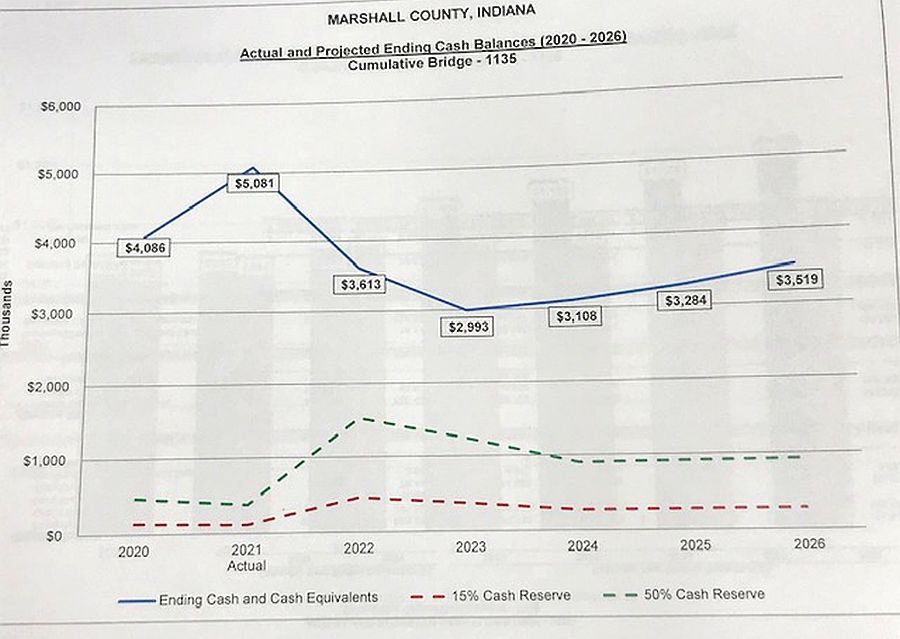

Bakertilly looked for reserve funds that could be used for road and bridge projects and found the Cumulative Bridge fund to be “pretty healthy.” As an example, they left a 50% cash reserve which would be 6-months of operating funds and the county would have just over $2 million for a one-time capital project.

In the Cum Capital Development Fund there aren’t a lot of excess reserve funds available. They were told there is about $138,000 that could be used for a one-time project. The county is slightly under the maximum statutory rate of .0333. Currently, the county rate is .0311 which is close to the max rate. Sansome said there was a piece of legislation passed earlier this year that will keep the CCD Fund rates constant, they won’t go down anymore. If the commissioners decide to reestablish the rate at the maximum, it will stay there. That action could generate additional annual revenue of $73,000 net of circuit breaker tax credits. They would have to act between January and the end of April.

In the Cum Bridge Fund Bakertilly showed the commissioners an increase in revenue between 2022 and 2023 in the amount of approximately $200,000 because the net assessed value is going up. Page Sansone said counties tend to build up funds and then do a project and then build up funds again for another project. While the county is spending down some of the reserves this year with bridge projects, they will still have plenty of reserves remaining. It was estimated they will end the year with about $3.6 million. While the fund is strong, bridge projects are expensive.

The chart of actual and projected ending cash balances for 2020-2026 shows where the county is with the Cum Bridge fund. (The dotted red line is the 15% cash reserve, and the dotted green line is the 50% cash reserve.) Marshall County’s cash reserve in the Cum Bridge fund (blue line) is well above, over 100%.

In the Local Road & Street Fund, there are strong cash reserves with about $800,000 in receipts annually and spending typically a little lower than the revenues. The fund is expected to end 2022 with $733,000 which is almost a 100% cash reserve level. There is about $345,000 in this fund for a one-time capital project.

The Highway Fund shows the county is spending down its cash reserves this year and had an additional appropriation of $1.4 million. There are also some cash reserves left over and the county should end the year with about $1.4 million if the Highway Dept. spends the whole budget. That is about a 37% cash reserve which is still strong. Commissioner Kevin Overmyer said the Highway Department still has $1 million of the relinquishment money from INDOT for taking over 31 north of Plymouth to the county line.

Sansone said, “Moving forward, again we are looking at strong cash reserves here. You can actually increase your budget from what we are seeing in 2023 and 2024. Right now, we have your budget in there that is certified at $2.3 but you could do additional appropriations of $400,000 and still maintain a very strong cash reserve.”

Bakertilly said the funds that were analyzed are in really good shape.