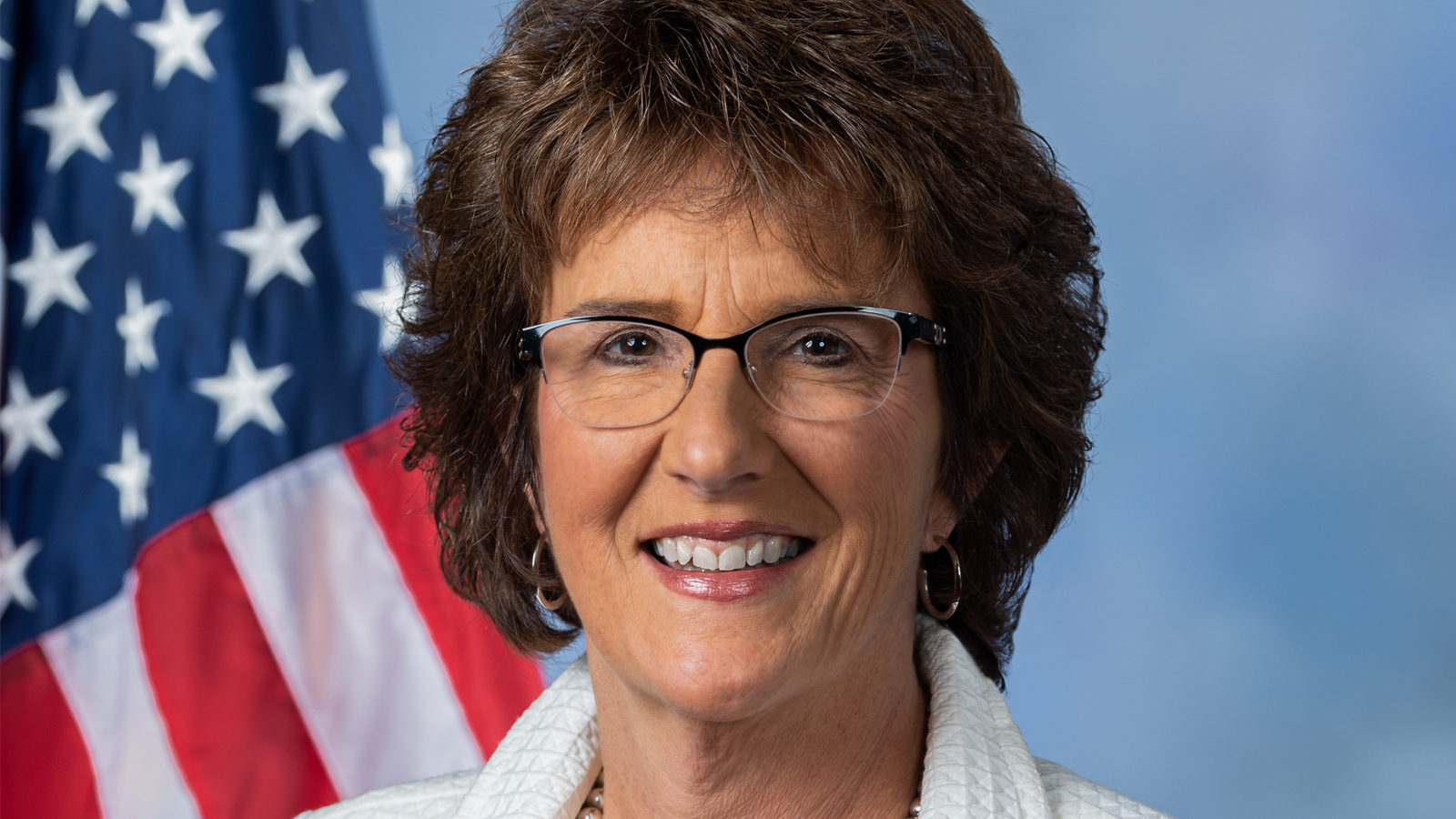

Congresswoman Jackie Walorski (R-Ind.), a senior member of the House Ways and Means Committee, released the below statement after the U.S. House of Representatives advanced H.R. 2954, the Securing a Strong Retirement (SECURE 2.0) Act of 2022.

“Hardworking Hoosiers understand firsthand the value of investing wisely to build a strong financial future. SECURE 2.0 builds on our previous work to uplift Americans toward financial prosperity. This bipartisan legislation includes vital provisions to help workers across the board take control of their futures by rolling back red tape that hinders retirement savings and expanding flexibility to ensure all American workers can benefit.

“Too many Americans, particularly women and military spouses, fell behind in retirement planning during the uncertainty of recent years. SECURE 2.0 will take important steps to bridge this gap by incentivizing small businesses to invest in their workforce and empowering workers to share success through small business employee stock ownership plans. It also would incentivize small businesses to offer retirement benefits for military spouses, one of my priorities to ensure families who sacrifice so much in service to our nation can achieve financial security. I was proud to help steward SECURE 2.0 across the finish line, and I urge the Senate to pass it expeditiously so that we can deliver tangible results for the American people.”

BACKGROUND

SECURE 2.0 would help Americans save for retirement at all stages of their career. It includes provisions to build on the SECURE Act of 2019 to improve Americans’ ability to invest in a stronger financial future.

Congresswoman Walorski has championed several key provisions, including a tax credit for small employers that make benefits more available to military spouses. Additionally, she advocated to expand benefits for employee stock ownership plans (ESOPs) to support American workers.

Additional highlights of SECURE 2.0 include provisions to:

- Create new tax credits to encourage small employers to offer retirement plans.

- Prioritize military families by providing a tax credit for small employers that make plan benefits more available to military spouses.

- Secure greater flexibility for Americans to keep more of their savings for longer by raising the age for required minimum distributions to 75.

- Help late career workers catch up in saving for retirement.

- Simplify the way small businesses offer stock ownership to employees by cutting red tape and offering tax incentives for small business employee stock ownership plans.

Read the full text of SECURE 2.0 here.

Walorski represents the 2nd Congressional District of Indiana, serving as a member of the House Ways and Means Committee and the Ranking Member of the House Ethics Committee.