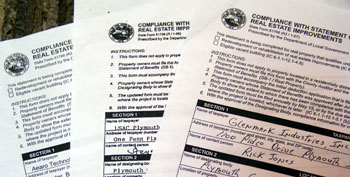

04/28/11 Monday night Plymouth City’s Attorney, Nelson Chipman presented members of the City Council with Tax Abatement Compliance Forms for three companies.

04/28/11 Monday night Plymouth City’s Attorney, Nelson Chipman presented members of the City Council with Tax Abatement Compliance Forms for three companies.

Aearo Technologies at 2925 Gary Drive in Plymouth was granted a Tax Abatement in 2008 for personal property and real estate. Their projections on personal property was for manufacturing equipment with an estimated value of $960,000 and the actual value was $949,689; I.T. equipment estimated at $70,000 and an actual value of $4,479 and logistic equipment estimated at $30,000 with an actual value of $38,513. Aearo Technologies’ tax abatement also included real estate for the construction of a 25,000 square foot office, production and warehouse facility at a total cost of $2,421,000. The estimated the addition of 42 new employees and at this point have only added 22 employees. Chipman noted that they have substantial compliance

Glenmark Industries at 1100 Pidco Drive was granted a tax abatement in 2005 for the purchase of various manufacturing and tooling equipment and building improvements for manufacturing operations. The estimated cost of the proposed equipment was $440,000 with the actual cost being $695,000. Estimated building improvements were $750,000 with the actual cost being $632,953. Glenmark Industries projected the addition of 43 employees with estimated salaries of $1,247,000 and currently have added 99 jobs with an actual salary of $3,011,177. Glenmark met all compliance requirements.

The final Tax Abatement Compliance Form was from LSAC Plymouth LP, a New York based company that was approved in 2000 by Marshall County for a 150,000 square foot warehouse and distribution facility. In 2003 they wanted to build a second 150,000 square foot warehouse and distribution facility and were annexed into the city at 2935 Van Vactor Drive. The project was estimated at $4,618,000 and the actual cost was $4,903,800. They had also estimated the addition of 7 new employees with an estimated salary of $171,000. The actual additional salaries were $220,296,000. LSAC Plymouth met all compliance requirements.

The Plymouth Common Council reviewed and accepted the three Tax Abatement Compliance Forms.