When it comes to Indiana housing industry, the factors of supply and demand are working well on a local level, says new research from Ball State University.

When it comes to Indiana housing industry, the factors of supply and demand are working well on a local level, says new research from Ball State University.

While the Indianapolis area is in a building boom, areas of the state that have experienced population loss are most at risk of too many empty single-family houses, according to the study, “Economic Considerations for Indiana’s Housing Markets.”

Indiana has roughly 316,000 such units, which is enough vacant homes to house nearly a third of the state’s residents. And, about 62 counties face markets where speculative new home construction is not profitable.

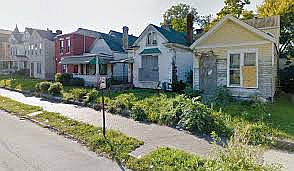

“Much of this enormous vacant housing stock is not readily suited for new residents,” noted Dagney Faulk, director of research at Ball State’s Center for Business and Economic Research (CBER). “Individual homes may be badly decayed, or the homes may be located in undesirable neighborhoods.”

But the presence of so many empty homes, as well as a home building industry facing unprofitable conditions, are challenges that Indiana shares with other Midwestern states, the study found.

“Across Indiana, the fundamentals of market supply and demand explain nearly all the variation in home prices,” said co-author and CBER Director Michael Hicks, the George and Frances Ball distinguished professor of economics. “Chief among these market conditions are local school quality, amenities and population change.

Hicks noted that Indiana is home to one very large and robust urban and suburban housing market, the greater Indianapolis metropolitan area. This 11-county region has absorbed all the net population growth in Indiana for a generation and is projected to see population growth that is larger than the state’s as a whole for the next generation.

The study found that the residual effect of growth in central Indiana means the state’s remaining counties — even metropolitan counties that are part of the large urban areas of Chicago, Cincinnati and Louisville, Kentucky — have lost and will continue to lose net population. As of 2016, Indiana counties averaged a home vacancy rate of 12.2 percent and a rental vacancy rate of 8.5 percent

The study also found:

- The Great Recession reduced both housing prices and new home construction in Indiana. However, the cost of constructing a new home has continued to rise, making new home construction unprofitable to speculative home builders across much of Indiana.

- Speculative new home construction is clearly profitable in only 14 of 92 counties. In 62 counties, it’s clearly not profitable, and in the remaining 16 counties, the data doesn’t support a clear interpretation.

The problems many policymakers perceive in local housing markets are the result of market forces appropriately responding to changes in housing supply and demand, Hicks and Faulk concluded.

To address broad concerns about housing conditions in Indiana, they have developed several policy recommendations, including: consider economic dynamics of housing costs vs. local market value when promoting new construction; modify tax increment financing to stimulate appropriate residential growth; stabilize middle class communities; modulate the local housing supply; address the community’s